Explore Nexbex

"From services to products, explore what we offer to elevate your digital journey."

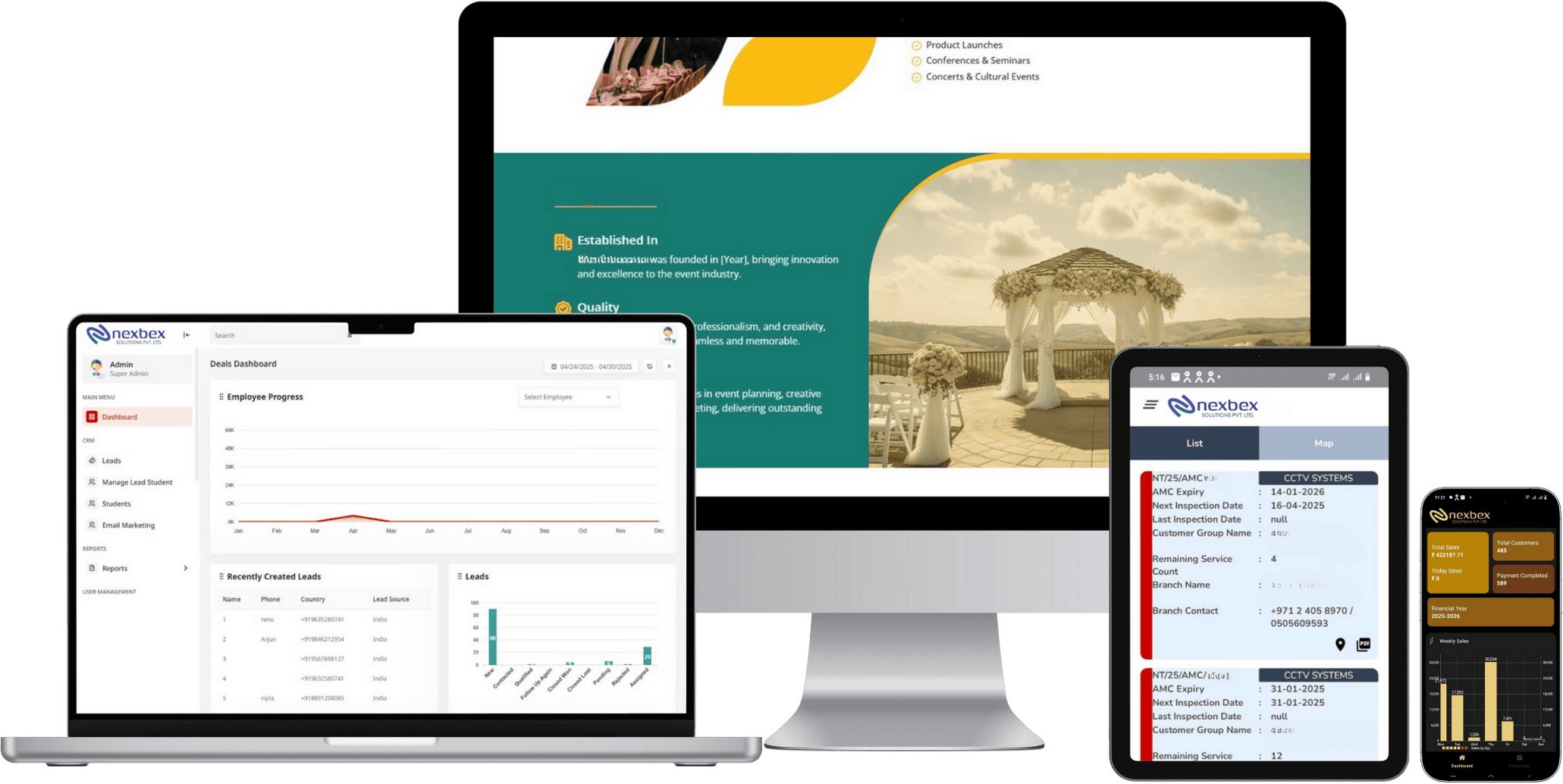

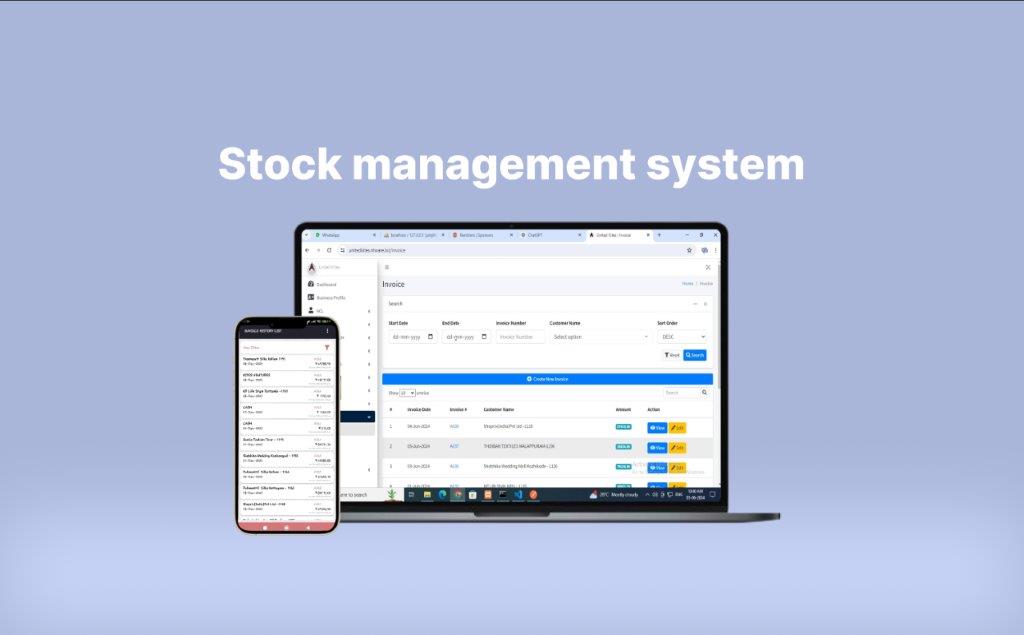

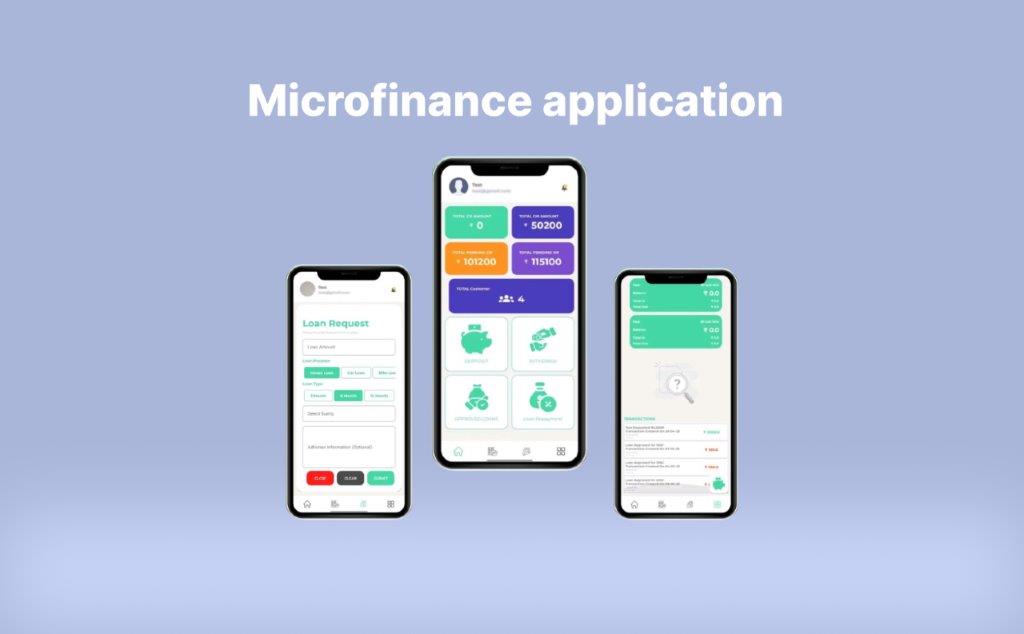

Products

Quality tools for digital excellence.

Portfolio

Our best works, showcased.

Gallery

Visuals that tell our story.

Home

Services

Innovative solutions for your success.

Blog

Trends, insights & updates.

Contact

Let’s connect today!